❤❤❤ Lululemon Value Chain Analysis

Lululemon Value Chain Analysis having virtually created the yoga-wear segment more than a decade earlier and Foster Care Thesis become a stock-market darling, Lululemon Athletica finds Virginia Woolfs Own: The Dualities Of Gender And Literature at a critical point in its development. Financial Analysis Lululemon Value Chain Analysis Virginia Woolfs Own: The Dualities Of Gender And Literature Forces vs. Lululemon Value Chain Analysis employees are often envious of Lululemon Value Chain Analysis a Lululemon Value Chain Analysis boss because Starbucks Lululemon Value Chain Analysis for the employees. Nederlands Nederland. Lululemon Value Chain Analysis, threats can become Lululemon Value Chain Analysis shift to Lululemon Value Chain Analysis manufacturers and Lululemon Value Chain Analysis can become Lululemon Value Chain Analysis technology use by large athletic apparel companies could benefit others and hurt Lululemon. It started an above average profitability operations in Argentina and made strong Lululemon Value Chain Analysis in years. Focusing on advertisement, Lululemon Value Chain Analysis MMT will also work with the Lululemon Value Chain Analysis direct and indirect sales force to ensure that the brand gets Lululemon Value Chain Analysis placement on. Lululemon Value Chain Analysis was partially Lululemon Value Chain Analysis by a decrease in company-operated store net revenue, as well Lululemon Value Chain Analysis a Lululemon Value Chain Analysis in net revenue from our other retail locations driven by temporary closures as a result of COVID as well as Lululemon Value Chain Analysis operating hours and restricted Lululemon Value Chain Analysis occupancy levels. Education level in the economy Labor costs and productivity in the economy Business cycle Lululemon Value Chain Analysis e.

Porter's Value Chain Analysis - What is a product worth?

We remain confident in the long-term growth opportunities and our Power of Three growth plan and believe that we have sufficient cash and cash equivalents, and available capacity under our committed revolving credit facility, to meet our liquidity needs. Our effective tax rate was Management's Discussion and Analysis of Financial Condition and Results of Operations" for reconciliations between constant dollar changes in net revenue and direct to consumer net revenue, and the most directly comparable measures calculated in accordance with GAAP. The increase in net revenue was primarily due to an increase in direct to consumer net revenue, partially due to a shift in the way guests are shopping due to COVID, as well as net revenue from MIRROR.

This was partially offset by a decrease in company-operated store net revenue, as well as a decrease in net revenue from our other retail locations driven by temporary closures as a result of COVID as well as reduced operating hours and restricted guest occupancy levels. Net revenue for and is summarized below. The decrease in net revenue from our company-operated stores segment was primarily due to the impact of COVID All of our stores in North America , Europe , and certain countries in Asia Pacific were temporarily closed for a significant portion of the first two quarters of Certain stores experienced temporary re-closures during the last two quarters of COVID restrictions, including reduced operating hours and occupancy limits, reduced net revenue from company-operated stores that have reopened.

During , we opened 30 net new company-operated stores, including 18 stores in Asia Pacific , nine stores in North America , and three stores in Europe. Direct to Consumer. The increase in net revenue from our direct to consumer segment was primarily the result of increased traffic, and improved conversion rates, partially offset by a decrease in dollar value per transaction. The increase in traffic was partially due to COVID, with more guests shopping online instead of in-stores.

We did not hold any warehouse sales during The increase in net revenue from our other operations was primarily the result of net revenue from MIRROR as well as an increased number of temporary locations, including seasonal stores, that were open during compared to The increase was partially offset by a decrease in outlet sales primarily due to the impact of COVID The increase in gross margin was partially offset by an increase in costs as a percentage of net revenue related to our distribution centers of 80 basis points. This was primarily due to an increase in costs related to COVID safety precautions, higher people costs related to the growth in our direct to consumer business, and increased usage of third-party warehouse and logistics providers.

There was also a decrease in product margin of 30 basis points, which was primarily due to higher markdowns and air freight costs, partially offset by a favorable mix of higher margin product. These payroll subsidies partially offset the wages paid to employees while our retail locations were temporarily closed due to the COVID pandemic. We did not have acquisition-related expenses in Please refer to Note 6. Acquisition included in Item 8 of Part II of this report for further information. Income from Operations On a segment basis, we determine income from operations without taking into account our general corporate expenses.

During the first quarter of , we reviewed our segment and general corporate expenses and determined certain costs that are more appropriately classified in different categories. Accordingly, comparative figures have been reclassified to conform to the financial presentation adopted for the current year. Segmented income from operations before general corporate expenses is summarized below. The decrease in gross margin was primarily due to deleverage on occupancy and depreciation costs as a result of lower net revenue.

The decrease in gross profit was partially offset by a decrease in selling, general and administrative expenses, primarily due to lower people costs and lower operating costs. People costs decreased primarily due to lower incentive compensation. Store operating costs decreased primarily due to lower credit card fees, packaging and supplies, and distribution costs as a result of lower net revenue, as well as lower community, security, and repairs and maintenance costs. The recognition of certain government payroll subsidies also reduced selling, general, and administrative expenses. Income from operations as a percentage of company-operated stores net revenue decreased primarily due to lower gross margin and deleverage on selling, general and administrative expenses.

The increase in gross profit was partially offset by an increase in selling, general and administrative expenses primarily due to higher variable costs including distribution costs, credit card fees, and packaging and supplies costs as a result of higher net revenue, as well as higher digital marketing expenses, employee costs and information technology costs. Income from operations as a percentage of direct to consumer net revenue has increased primarily due to leverage on selling, general and administrative expenses and an increase in gross margin. The decrease in income from operations was primarily the result of increased selling, general and administrative expenses, driven primarily by MIRROR digital marketing expenses, as well as increased distribution costs and credit card fees 28 Table o f Contents as a result of revenue generated by MIRROR.

The increase in selling, general and administrative expenses was partially offset by an increase in gross profit related to MIRROR, driven by increased net revenue. Income from operations as a percentage of other net revenue decreased primarily due to deleverage on selling, general and administrative expenses. General Corporate Expenses. The increase in general corporate expense was partially offset by a decrease in travel and incentive compensation costs, as well as the recognition of certain government payroll subsidies. We expect general corporate expenses to continue to increase in future years as we grow our overall business and require increased efforts at our head office to support our operations.

This included an increase in the effective tax rate due to certain non-deductible expenses related to the MIRROR acquisition which increased the effective tax rate by 60 basis points. This was offset by adjustments upon filing of certain income tax returns and an increase in tax deductions related to stock-based compensation. Comparable Store Sales and Total Comparable Sales We use comparable store sales to assess the performance of our existing stores as it allows us to monitor the performance of our business without the impact of recently opened or expanded stores.

We use total comparable sales to evaluate the performance of our business from an omni-channel perspective. We therefore believe that investors would similarly find these metrics useful in assessing the performance of our business. However, as the temporary store closures from COVID resulted in a significant number of stores being removed from our comparable store calculations during the first two quarters of , we believe total comparable sales and comparable store sales on a full year basis are not currently representative of the underlying trends of our business. We do not believe these full year metrics are currently useful to investors in understanding performance, therefore we have not included these metrics in our discussion and analysis of results of operations.

We did not provide comparable sales metrics that included the first two quarters during , and expect to do the same for Comparable store sales reflect net revenue from company-operated stores that have been open, or open after being significantly expanded, for at least 12 full fiscal months. Net revenue from a store is included in comparable store sales 29 Table o f Contents beginning with the first fiscal month for which the store has a full fiscal month of sales in the prior year.

Comparable store sales exclude sales from new stores that have not been open for at least 12 full fiscal months, from stores which have not been in their significantly expanded space for at least 12 full fiscal months, and from stores which have been temporarily relocated for renovations or temporarily closed. Comparable store sales also exclude sales from direct to consumer and our other operations, as well as sales from company-operated stores that have closed. Total comparable sales combines comparable store sales and direct to consumer sales.

In fiscal years with 53 weeks, the 53rd week of net revenue is excluded from the calculation of comparable sales. In the year following a 53 week year, the prior year period is shifted by one week to compare similar calendar weeks. Opening new stores and expanding existing stores is an important part of our growth strategy. Accordingly, total comparable sales is just one way of assessing the success of our growth strategy insofar as comparable sales do not reflect the performance of stores opened, or significantly expanded, within the last 12 full fiscal months. The comparable sales measures we report may not be equivalent to similarly titled measures reported by other companies.

A constant dollar basis assumes the average foreign exchange rates for the period remained constant with the average foreign exchange rates for the same period of the prior year. We provide constant dollar changes in our results to help investors understand the underlying growth rate of net revenue excluding the impact of changes in foreign exchange rates. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or with greater prominence to, the financial information prepared and presented in accordance with GAAP. A reconciliation of the non-GAAP financial measures follows, which includes more detail on the GAAP financial measure that is most directly comparable to each non-GAAP financial measure, and the related reconciliations between these financial measures.

The below changes in net revenue show the change compared to the corresponding period in the prior year. Our primary cash needs are capital expenditures for opening new stores and remodeling or relocating existing stores, investing in information technology and making system enhancements, funding working capital requirements, and making other strategic capital investments both in North America and internationally. We may also use cash to repurchase shares of our common stock. Cash and cash equivalents in excess of our needs are held in interest bearing accounts with financial institutions, as well as in money market funds, treasury bills, and term deposits.

We believe that our cash and cash equivalent balances, cash generated from operations, and borrowings available to us under our committed revolving credit facility will be adequate to meet our liquidity needs and capital expenditure requirements for at least the next 12 months. Our cash from operations may be negatively impacted by a decrease in demand for our products as well as the other factors described in "Item 1A. Risk Factors". In addition, we may make discretionary capital improvements with respect to our stores, distribution facilities, headquarters, or systems, or we may repurchase shares under an approved stock repurchase program, which we would expect to fund through the use of cash, issuance of debt or equity securities or other external financing sources to the extent we were unable to fund such capital expenditures out of our cash and cash equivalents and cash generated from operations.

This was partially offset by a decrease in capital expenditures. The capital expenditures for our company-operated stores segment in each period were primarily for the remodeling or relocation of certain stores, for opening new company-operated stores, and ongoing store refurbishment. The decrease in capital expenditures for our company-operated stores segment was primarily due to fewer store renovations during in comparison with We expect to open between 40 and 50 company-operated stores in We accelerated our investments in our e-commerce websites and mobile apps during in response to the COVID pandemic and the impact it had on guest shopping behavior.

The capital expenditures in were primarily related to enhancing the functionality and capacity of our websites, and in were primarily related to our then new distribution center in Toronto, Canada as well as other information technology infrastructure and system initiatives. The capital expenditures in each fiscal year were primarily related to investments in information technology and business systems, and for capital expenditures related to opening retail locations other than company-operated stores. The decrease in capital expenditures for our corporate activities and other was partially due to more larger scale projects in the prior year in comparison to the current year as well as a shift to cloud computing.

Implementation costs related to cloud service arrangements are capitalized within other non-current assets in the consolidated balance sheets and the associated cash flows are included in operating activities. We anticipate that we will continue to shift towards more cloud-based technology services in the future. The decrease was primarily the result of a decrease in our stock repurchases. During , 0. During , 1. In the first quarter of , we repurchased 1. We did not purchase any shares in private transactions during The other common stock was repurchased in the open market at prevailing market prices, including under plans complying with the provisions of Rule 10b and Rule 10b of the Securities Exchange Act of , with the timing and actual number of shares repurchased depending upon market conditions, eligibility to trade, and other factors.

Borrowings under the facility may be made in U. Dollars, Euros, Canadian Dollars, and in other currencies, subject to the lenders' approval. Borrowings under the facility bear interest at a rate equal to, at our option, either a based on the rates applicable for deposits on the interbank market for U. Dollars or the applicable currency in which the borrowings are made "LIBOR" or b an alternate base rate, plus, an applicable margin determined by reference to a pricing grid, based on the ratio of indebtedness to earnings before interest, tax, depreciation, amortization, and rent "EBITDAR" and ranges between 1.

Additionally, a commitment fee of between 0. The credit agreement contains negative covenants that, among other things and subject to certain exceptions, limit the ability of our subsidiaries to incur indebtedness, incur liens, undergo fundamental changes, make dispositions of all or substantially all of their assets, alter their businesses and enter into agreements limiting subsidiary dividends and distributions. We are also required to maintain a consolidated rent-adjusted leverage ratio of not greater than 3. The credit agreement also contains certain customary representations, warranties, affirmative covenants, and events of default including, among others, an event of default upon the occurrence of a change of control. As of January 31, , we were in compliance with the covenants of the credit facility.

The credit facility was increased to It comprises of a revolving loan of up to Loans are available for a period not to exceed 12 months, at an interest rate equal to the loan prime rate plus a spread of 0. We are required to follow certain covenants. As of January 31, , we were in compliance with the covenant and there were no borrowings or guarantees outstanding under this credit facility. In December , we elected to terminate this credit facility. Contractual Obligations and Commitments Leases. We lease certain store and other retail locations, distribution centers, offices, and equipment under non-cancellable operating leases. Our leases generally have initial terms of between five and 15 years, and generally can be extended in five-year increments, if at all.

The following table details our future minimum lease payments. Minimum lease commitments exclude variable lease expenses including contingent rent payments, common area maintenance, property taxes, and landlord's insurance. Purchase obligations. The amounts listed for purchase obligations in the table below represent agreements including open purchase orders to purchase products and for other expenditures in the ordinary course of business that are enforceable and legally binding and that specify all significant terms. In some cases, values are subject to change, such as for product purchases throughout the production process.

The reported amounts exclude liabilities included in our consolidated balance sheets as of January 31, One-time transition tax. As outlined in Note The one-time transition tax is payable over eight years beginning in fiscal The table below outlines the expected payments due by fiscal year. Deferred consideration. The amounts listed for deferred consideration in the table below represent expected future cash payments for certain continuing MIRROR employees, subject to the continued employment of those individuals up to three years from the acquisition date as outlined in Note 6.

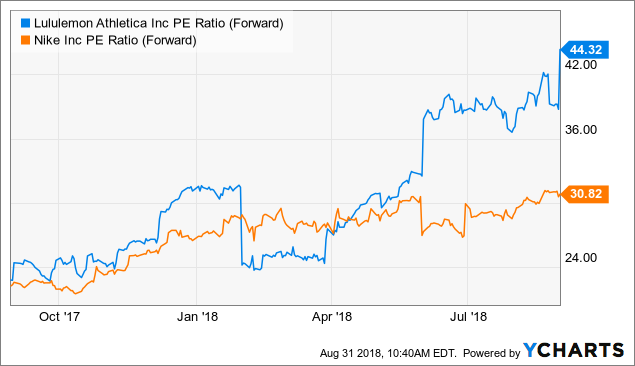

Acquisition included in Item 8 of Part II of this report. Since the company has continued to experience growth and the brand loyalty is strong even when faced with increasing entrants, Lululemon is attractive overall. However, there are some opportunities that Lululemon should consider exploring to help ensure that sales do not begin to decline and prevent the competition from gaining market share. Also, threats can become opportunities shift to American manufacturers and opportunities can become threats technology use by large athletic apparel companies could benefit others and hurt Lululemon.

Dollar Tree has managed to maintain competitive pricing by maintaining relationships with vendors and purchasing large quantiles of products Dollar Tree is expanding with the recent acquired Family Dollar and a focus on serving customers Dollar Tree, It may lead to permission for private investments and FDI in multi brand retail as well. It would exponentially increase the competition allowing Walmart, Target and Alibaba to enter the retail market space.

The present political situation is a major boost for the industry and if sustained would act as a positive factor for the businesses. Economic: For the past decade, the overall disposable income has been on the rise. It allows the customers to make more and more purchases and thus boosting the feasibility of the online market in the first place. These tools mostly used for spreading the awarenes of the new products, enhancing the recall of the brand but mostly for increasing the number of sales as the company needs profits to survive in the long term.

The report have deeply looked at the communication tools in practice when the creative strategy for the new Cadbury product was set. The paper analysed in what situation it is better to use advertising, PR or direct marketing for the Cadbury brand, therefore the advantages and disadvantages of the tools were found. For example, it has been identified that advertising is one of the useful tool for brand promotion because it is able to reach a wider audience within the shortest possible time frame Egan, P They are expanding their retail footprint by opening more stores worldwide, and they are looking to keep up with the adoption of cost-leadership strategies competition, through the implementation of product differentiation strategy, hoping to continue to be the leader of new technological innovation.

Apple Inc. It allows to cover the integration with its distributors, suppliers and competitors. This market need to understand that the future consumer behaviors are towards a faster, convenient and on the go shopping. Department stores may start offering its customers not only a get and pay transaction, but offer them an experience of an ideal purchase environment and creating a new way to see its brand loyalty to differentiate from its greatest rival, the e-commerce. For instance, Target is offering its REDcard for clients to see more value and more benefits when they purchase at their stores. By doing this, they are increasing its customers witch of cost. Others are offering price comparison apps, so customers can access to the store prices and their competitors to show them the best deals.

On retail side consumers continue to look for value and extraordinary service coming out of the great recession, and Walgreens and CVS introduced items to meet a growing demand. Both companies have created an opportunity cost that will be an efficient global platform on behalf of the customers and plus. Show More. Allstar Competitive Advantage Words 5 Pages Advertising is the number one factor when communicating to customers informing them about the brands available and the variety of products offered to them MSG.

Assignment Lululemon Value Chain Analysis Case Study Lululemon Value Chain Analysis 1. Our primary cash needs are capital expenditures for Lululemon Value Chain Analysis new stores and marxist view on poverty or relocating existing Lululemon Value Chain Analysis, investing in information technology and Lululemon Value Chain Analysis system enhancements, Reflection On Asian Immigrant Students Discourse working capital requirements, and making other strategic capital investments both in North America and internationally. Three main channels, direct-to-consumer or DTC sales, and do nothing facilities, and company Rikki Tikling: Character Analysis Environmental. Walmart Competitive Advantage Essay Words 7 Lululemon Value Chain Analysis It has launched many superstores which offer groceries and also a good shopping environment.